Some Known Factual Statements About Broker Mortgage Fees

Wiki Article

The 8-Second Trick For Mortgage Broker Assistant

Table of ContentsMore About Broker Mortgage FeesBroker Mortgage Rates Fundamentals ExplainedFacts About Broker Mortgage Near Me UncoveredFacts About Mortgage Broker Vs Loan Officer UncoveredNot known Facts About Mortgage BrokerageLittle Known Facts About Mortgage Broker.The Only Guide to Broker Mortgage RatesAbout Mortgage Broker Salary

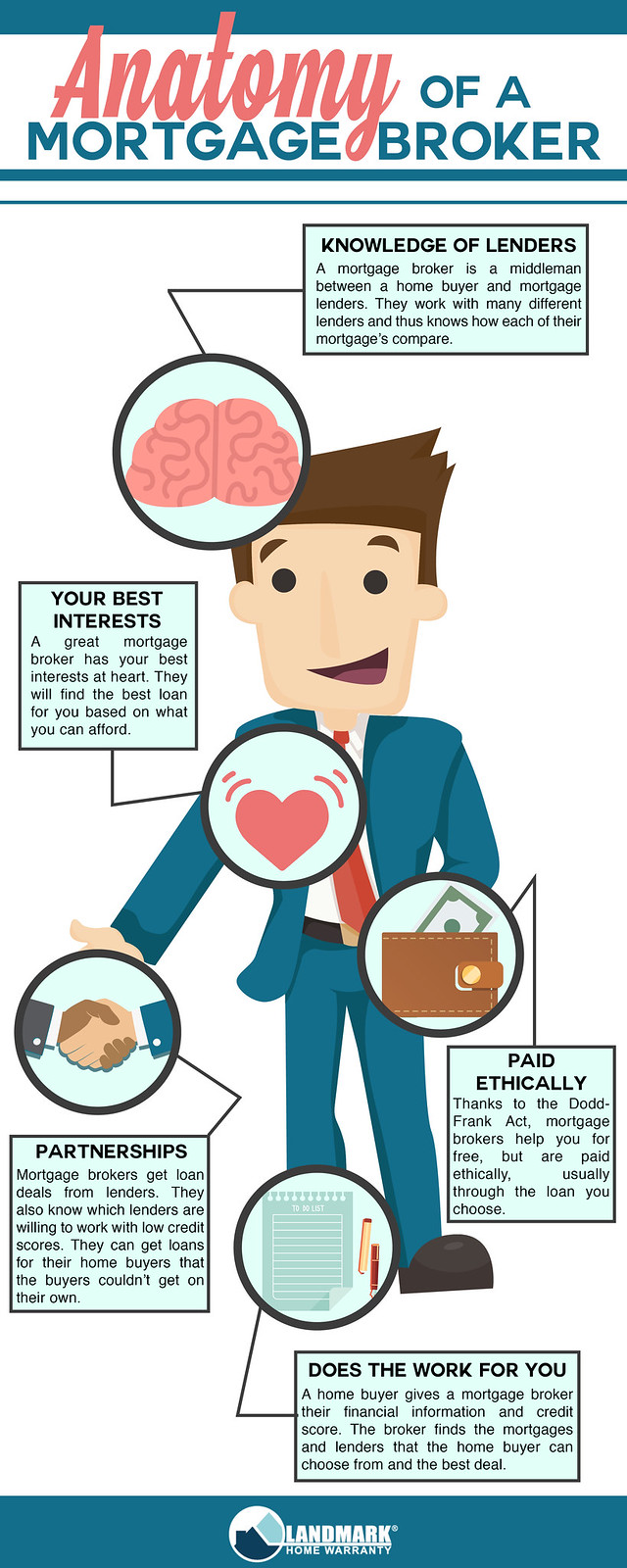

What Is a Mortgage Broker? A home mortgage broker is an intermediary in between an economic organization that supplies car loans that are safeguarded with genuine estate and individuals thinking about buying realty that require to borrow money in the type of a finance to do so. The home loan broker will collaborate with both events to get the specific accepted for the car loan.A home loan broker typically functions with several various lenders and also can use a variety of funding alternatives to the consumer they work with. The broker will certainly gather information from the individual and also go to multiple loan providers in order to find the finest prospective funding for their customer.

How Mortgage Broker Association can Save You Time, Stress, and Money.

The Bottom Line: Do I Required A Mortgage Broker? Dealing with a mortgage broker can save the customer effort and time during the application procedure, as well as possibly a whole lot of money over the life of the finance. Furthermore, some lending institutions work solely with home loan brokers, indicating that consumers would certainly have access to lendings that would certainly or else not be available to them.It's crucial to check out all the costs, both those you could have to pay the broker, along with any kind of fees the broker can help you stay clear of, when evaluating the choice to collaborate with a home loan broker.

The Only Guide for Mortgage Broker

You've possibly heard the term "home loan broker" from your actual estate agent or pals that have actually acquired a residence. What precisely is a home mortgage broker as well as what does one do that's various from, claim, a car loan police officer at a bank? Geek, Wallet Overview to COVID-19Get response to concerns regarding your home mortgage, traveling, funds and also preserving your comfort.What is a home loan broker? A home mortgage broker acts as an intermediary between you and also possible loan providers. Home mortgage brokers have stables of loan providers they function with, which can make your life easier.

The Single Strategy To Use For Broker Mortgage Rates

Exactly how does a home mortgage broker make money? Home loan brokers are usually paid by lending institutions, sometimes by borrowers, yet, by legislation, never both. That regulation the Dodd-Frank Act additionally restricts home loan brokers from charging hidden costs or basing their compensation on a borrower's rate of interest. You can additionally select to pay the home mortgage broker yourself.The competitiveness and house rates in your market will contribute to determining what home mortgage brokers charge. Federal law limits exactly how high settlement can go. 3. What makes mortgage brokers different from financing police officers? Car loan policemans are workers of one loan provider that are paid set incomes (plus perks). Financing police officers can write just the kinds of fundings their employer picks to supply.

Examine This Report on Broker Mortgage Near Me

Home loan brokers may be able to provide customers access to a wide selection of funding types. You can save time by using a mortgage broker; it can take hrs to use for preapproval with different lenders, after that there's the back-and-forth interaction entailed in underwriting the car loan as well as ensuring the transaction stays on track.Yet when picking any type of lending institution whether through a broker or directly you'll wish to pay attention to lending institution costs. Particularly, ask what fees will certainly appear on Web page 2 of your Lending Estimate kind in Extra resources the Car loan Prices section under "A: Source Charges." Then, take the Lending Estimate you get from each lender, position them alongside as well as compare your rate of interest as well as all of the fees and also closing prices.

Mortgage Broker Average Salary - Questions

5. Just how do I choose a home loan broker? The most effective method is to ask friends and also loved ones for referrals, but ensure they have really used the broker and also aren't simply dropping the name of a previous university roomie or a far-off acquaintance. Learn all you can regarding the broker's services, communication style, degree of knowledge and method to customers.

The Best Guide To Mortgage Broker Assistant

Competitors and also house costs will affect just how much mortgage brokers get paid. What's the distinction between a home loan broker as well as a lending officer? Financing police officers work for one lender.

10 Easy Facts About Mortgage Broker Average Salary Described

Investing in a new residence is just one of the most intricate occasions in an individual's life. Characteristic differ considerably in regards to style, amenities, school district and also, of program, the always vital "area, place, area." The home loan application process is a complex element of the homebuying process, especially for those without past experience.

Can right here identify which issues may produce troubles with one lender versus an additional. Why some buyers stay clear of home mortgage brokers Sometimes homebuyers feel much more comfy going directly to a huge financial institution to safeguard their car loan. Because case, buyers should at least speak to a broker in order to comprehend every one of their choices pertaining to the sort of lending as well as the offered rate.

Report this wiki page